RBA Cash Rate Announcement

At its meeting today, the Reserve Bank of Australia (RBA) decided to keep the official cash rate at 0.25%. This follows two consecutive cash rate cuts to 0.50% and 0.25% in March.

With the global coronavirus (COVID-19) crisis coming off the back of the Australian bushfires, RBA decided to keep the cash rate to record lows to support the economy as it responds to these various crises. According to RBA governor Philip Lowe at the previous meeting, “At some point, the virus will be contained and the Australian economy will recover. In the interim, a priority for the Reserve Bank is to support jobs, incomes and businesses, so that when the health crisis recedes, the country is well placed to recover strongly.”

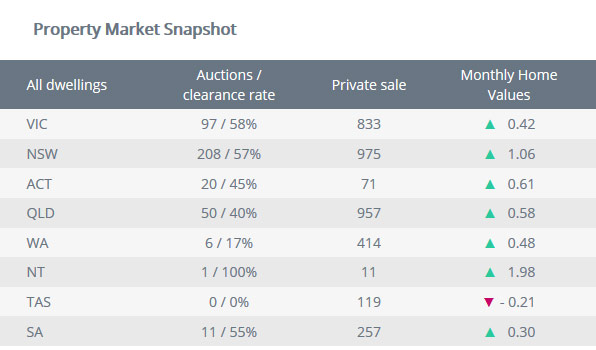

Along with the decline in the cash rate and changes to the fiscal and monetary policy, the housing market is also experiencing a sharp slowdown in activity, with the downside risk for housing values increasing. Moreover, CoreLogic forecasts that the slowdown in growth is likely to continue into negative in the coming months.

With this outlook, we may experience low interest rates for a while. You may want to compare available home loans to make sure you’re still getting a competitive offer that suits you. Get in touch with us so we can help you shop around for the right home loan and arrange a loan pre-approval!

If you have any finance related queries

Book a Consultation

When’s good for you?