RBA Cash Rate Announcement December 2025

At its final meeting of 2025, the Reserve Bank of Australia (RBA) kept the cash rate on hold at 3.60%. The pause comes despite inflation continuing to rise above target - a trend that sparked fresh concerns the RBA might be forced to lift rates again.

Read today’s official statement on the RBA’s website.

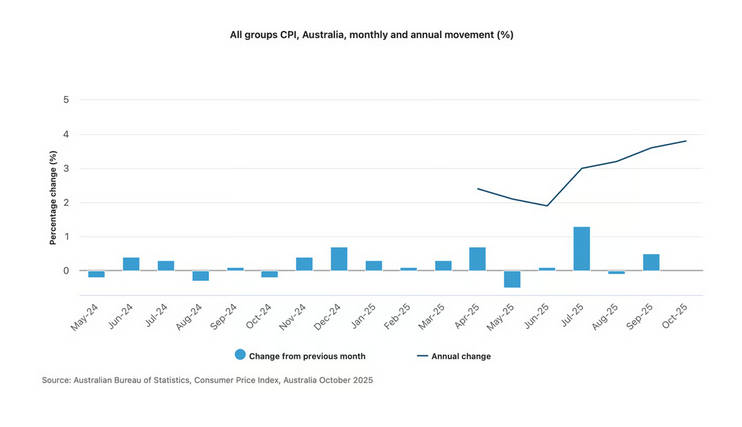

The Consumer Price Index (CPI) rose 3.8% in the 12 months to October, up from 3.6% in the 12 months to September.

Meanwhile, underlying inflation (as represented by the trimmed mean) was 3.3% in the 12 months to October, slightly up from 3.2% in the 12 months to September.

With both headline and underlying inflation drifting further above target, the RBA remains focused on bringing price growth back “sustainably” within its 2–3% range, ideally settling around the midpoint.

The hotter inflation numbers have left some economists anticipating cash rate hikes to come in early 2026 – a scenario few imagined just months ago. Others remain confident the RBA will remain on hold for an extended period as it waits for firmer evidence that inflation is easing.

All eyes will now turn to the RBA’s next meeting, with the following cash rate decision due on 3 February.

If you’re looking to buy a home or investment property this summer, now is a great time to explore your finance options and set yourself up for a strong start in the new year. Feel free to reach out and we can walk you through them.

Need help understanding what this announcement means for you? Contact us today.

If you have any finance related queries

Book a Consultation

When’s good for you?