RBA Cash Rate Announcement February 2026

At its first meeting of 2026, the Reserve Bank of Australia (RBA) has lifted the cash rate by 0.25 percentage points, taking it to 3.85%. This marks the RBA’s first cash rate increase since November 2023 and reflects ongoing concerns about inflation.

Read today’s official statement on the RBA’s website.

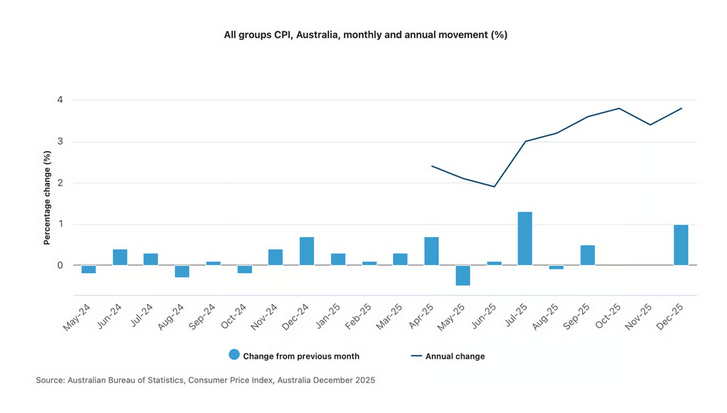

Australia’s inflation rate continues to trend upward, with the Consumer Price Index (CPI) rising 3.8% in the 12 months to December, up from 3.4% in November.

Underlying inflation, measured by the trimmed mean, was 3.3% over the same period, slightly higher than the 3.2% recorded in November.

The RBA’s goal is for inflation to sit “sustainably” within its target range of 2 to 3%, preferably around the midpoint. With price pressures proving stubborn, today’s increase was widely expected by the major banks.

According to Roy Morgan data, today’s cash rate hike could place additional pressure on household budgets, with around 1.3 million households potentially experiencing mortgage stress. A 0.25 per cent increase could add roughly $115 to the monthly repayment on an average $694,000 mortgage.

If you are feeling the impact, you are not alone. We can confirm whether your lender is passing on the increase, explain what it means for your repayments and help you assess whether a more competitive loan may be available.

And if buying property is part of your 2026 plans, we are here to help you explore your finance options and make sure you are prepared in a changing rate environment.

Many economists believe further rate rises remain a possibility in the months ahead.

The next cash rate decision will be announced on 17 March.

Need help understanding what this announcement means for you? Contact us today.

If you have any finance related queries

Book a Consultation

When’s good for you?