RBA Cash Rate Announcement September 2025

The Reserve Bank of Australia (RBA) has kept the cash rate on hold at 3.60 per cent, after the latest inflation figures came in higher than expected.

Read today’s official statement on the RBA’s website.

Headline inflation rose 3.0 per cent over the year to August, up from 2.8 per cent in July. This is the highest annual rate since July 2024.

Inflation is now at the top of the RBA’s 2-3 per cent target band. However, the RBA pays closer attention to underlying measures of inflation. Its preferred gauge - the trimmed mean - came in at a more comfortable 2.6 per cent, slightly lower than 2.7 per cent in the 12 months to July.

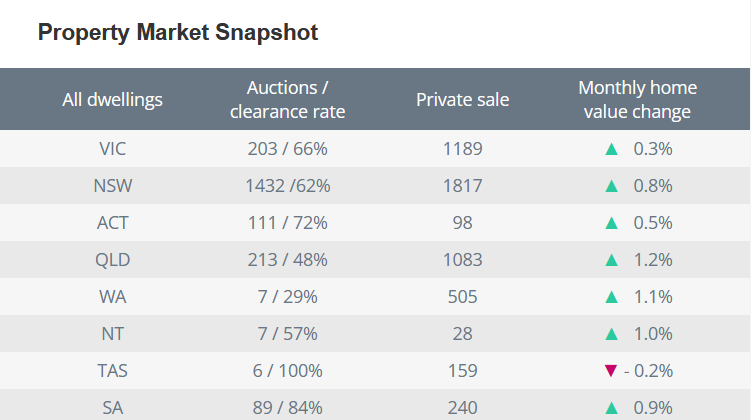

Housing costs have been one of the contributors to higher inflation. Across Australia, advertised property listings are down about 20 per cent compared to average levels, while buyer demand remains strong. This competitive environment is pushing prices higher, especially in the wake of three cash rate cuts this year, totalling 0.75 percentage points.

RBA Governor Michele Bullock recently indicated that households were not expected to feel the full impact on their finances of recent rate cuts until 2026.

“We think of the lags to be 12 to 18 months, but we are seeing early signs it is having an impact in housing credit,” she said.

If you’re looking to make a spring property purchase, talk to us about getting pre-approval today. It will give you certainty around what you can borrow and put you in a stronger position to negotiate or bid at auction when the right property comes along.

The next RBA cash rate decision will be announced on 4 November. With economists split on whether a cut is on the cards, we’ll keep you updated as the RBA continues to weigh inflation and economic conditions.

Need help understanding what this announcement means for you? Contact us today.

If you have any finance related queries

Book a Consultation

When’s good for you?